Get personalized advice

RESP Loans

Borrowing to contribute to your registered education savings plan (RESP) allows you to take full advantage of government grant programs and thereby save more for your child’s postsecondary education.

Why take out an RESP loan?

- You maximize your contributions to get all the grants to which you are entitled

- You can recover your unused grants from previous years

- You can increase your contributions without having to adjust your budget

- You benefit from a higher yield by investing additional amounts from contributions and grants received as a result of the RESP loan for your child.

The advantages of our RESP loan

- Flexible loan repayment as it can be done at any time, though it is not payable until the moment of RESP withdrawal

- Competitive interest rates

- Loan approval without a credit check

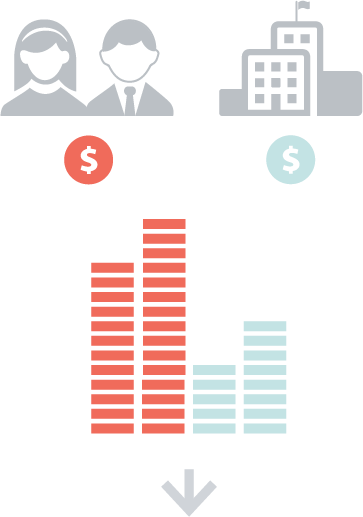

RESP with no loan

Contribute

You start saving early in your child’s RESP and take advantage of generous government grants.

Accumulate

Your regular contributions and grants generate interest. Your child’s RESP grows tax free.

Benefit

Your contributions are returned to you to fund your child’s education. Your child receives the grants and the total interest from the RESP.

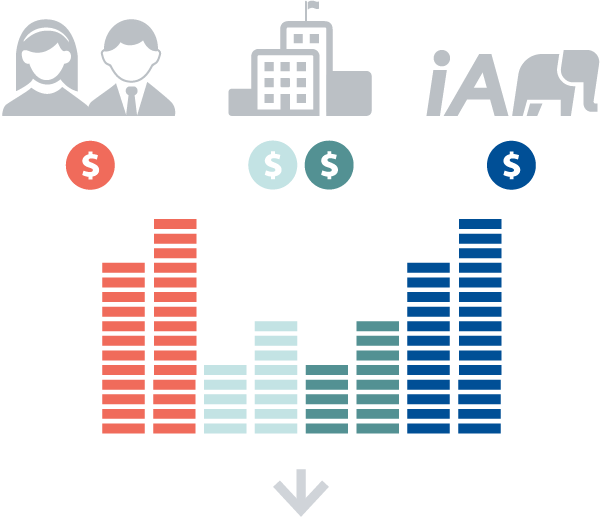

With an RESP loan

Contribute

In addition to your contributions and the added grants, iA Financial Group pays an amount that entitles you to additional grants.

Accumulate

The contributions, grants and RESP loan generate returns and grow tax free.

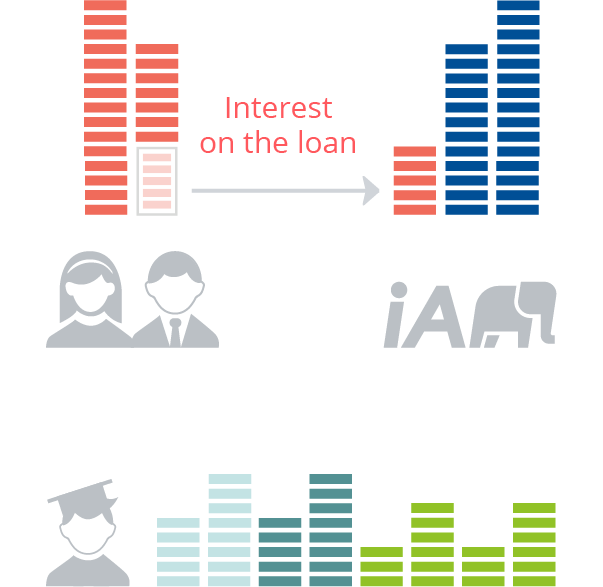

Benefit

Your child receives the grants and returns in full. You get back your contributions and pay off the loan interest. iA Financial Group recovers the loan amount.

RESP loan interest rate

The annual interest rate varies in accordance with the Royal Bank of Canada’s prime rate (currently at 5.95%), plus an adjustment (0.75%). The interest rates are provided for information purposes only and are subject to change at any time, without notice.

Effective interest rate

The effective interest rate is determined on the assumption that the annual interest rate remains unchanged and that the monthly interest has not been completely repaid at the end of each period. Currently, it is set at 6.91%.

How does an RESP loan work?

See how it pays to borrow in order to contribute more to your child’s RESP, and it’s easy too!